LATEST NEWS

Insights

Q4 Associate Hiring Summary

While Q4 is traditionally a quieter period for hiring, our latest data shows that the London legal market remained active right through to year end. Associate movement was sustained across multiple practice areas, reflecting continued confidence among firms despite seasonal slowdown and broader economic uncertainty.

Corporate & Commercial once again led the market with 148 Associate moves, followed closely by Real Estate (135) and Dispute Resolution (84). Finance also recorded solid activity, alongside steady movement across Private Client, HR (to include Employment), Insurance and TMT. Overall, Q4 provided a resilient and positive close to the year.

Shining the spotlight on…

Corporate & Commercial

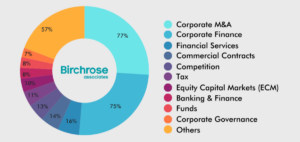

Corporate & Commercial remained the most active practice area throughout Q4, driven by strong demand in Corporate M&A (77 moves) and Corporate Finance (75 moves), alongside targeted hiring within Financial Services (16 moves). This activity has been supported by recent regulatory and market developments aimed at stimulating investment, listings and liquidity across UK markets.

Measures introduced in the Autumn Budget, including stamp duty exemptions for new listings, expanded venture capital thresholds and enhanced employee share schemes, have contributed to increased transactional and advisory work across both private and public markets. In parallel, ongoing reforms to AIM and Main Market frameworks have driven demand for Associates with experience in fundraisings, restructurings, governance and regulatory matters, reinforcing hiring momentum across the Corporate & Commercial space. (Source: https://www.macfarlanes.com/what-we-think/102eli5/corporate-law-update-22-28-november-2025-102lwd1/ )

Where Associate Movement Was Highest Within Corporate & Commercial

Dispute Resolution

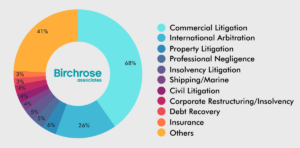

Dispute Resolution saw continued Associate movement during Q4, against a backdrop of wider changes in how disputes are being managed. As highlighted in the Corporate Law Update: 22–28 November 2025, mediation is increasingly positioned as a central component of modern dispute resolution, driven by regulatory pressure, rising caseloads and growing expectations for faster and more proportionate outcomes.

The article notes that dispute resolution activity is expanding, with global research indicating annual growth of approximately 9–10% across the wider disputes and conflict management market. It also highlights a growing emphasis on early intervention and the normalisation of digital and hybrid mediation, both of which are increasing the volume of disputes handled at earlier stages. Together, these developments point to sustained demand for Dispute Resolution expertise as organisations adapt their approaches to managing and resolving disputes (Corporate Law Update: 22–28 November 2025).

Where Associate Movement Was Highest Within Dispute Resolution

RELATED INSIGHTS

The Gender Gap in Law: Representation Doesn’t Equal Inclusion

The shortlisted nominees for the Women and Diversity Law Awards 2026 are out, and it’s the perfect…

The UK legal sector in 2026: technology, regulation and a changing talent market

2026 is shaping up to be a defining year for the UK legal sector. Artificial intelligence is…